Avoiding Financial Fumbles: Mastering Behavioral Biases

When it comes to investing, there are a multitude of factors that can influence our decisions. From market trends to economic indicators, it can be easy to get caught up in the noise and make decisions based on emotion rather than logic. One of the biggest pitfalls that investors face is falling victim to behavioral biases.

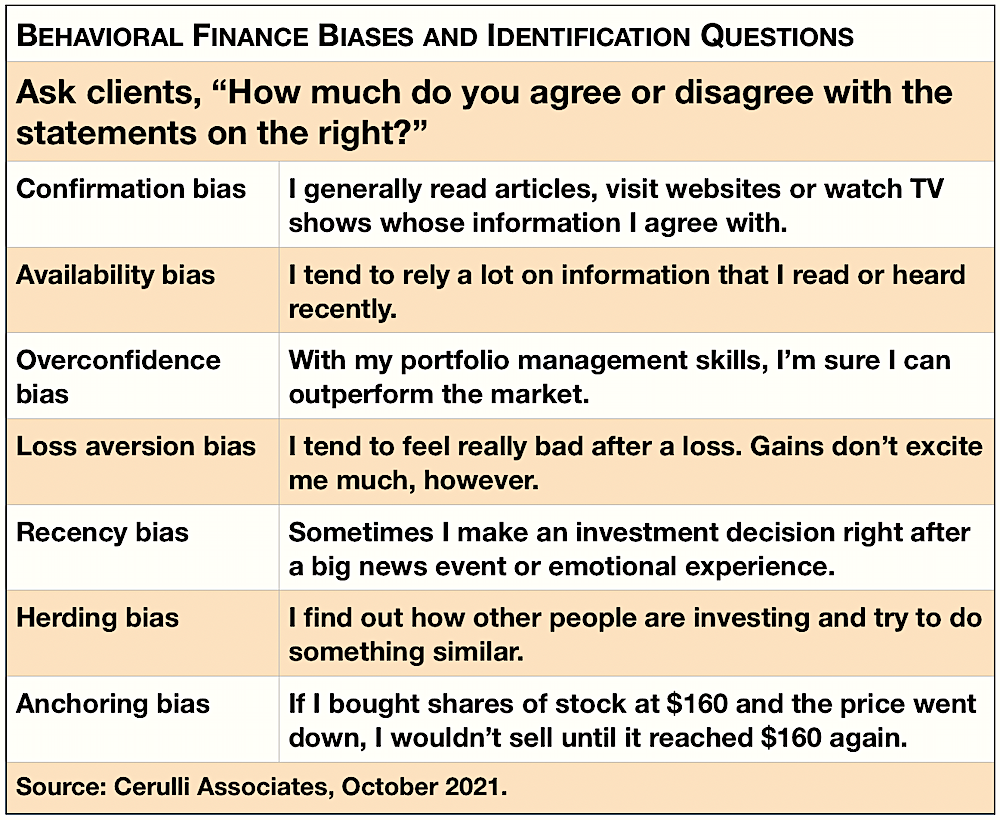

Behavioral biases are the psychological tendencies that cause us to make irrational decisions when it comes to our finances. These biases can lead us to buy high and sell low, hold onto losing investments for too long, and ignore important information that goes against our preconceived notions.

One of the most common behavioral biases that investors face is overconfidence. This bias leads us to believe that we know more than we actually do, causing us to take on more risk than we should. Overconfidence can also lead us to ignore warning signs that should give us pause before making an investment decision.

Another common bias is loss aversion, which causes us to feel the pain of losses more acutely than the pleasure of gains. This can lead us to hold onto losing investments in the hopes that they will turn around, even when it would be wiser to cut our losses and move on.

Image Source: retirementincomejournal.com

Confirmation bias is another dangerous bias that can cloud our judgment when it comes to investing. This bias causes us to seek out information that confirms our pre-existing beliefs while ignoring information that challenges them. This can lead us to make decisions based on faulty or incomplete information, leading to poor investment choices.

Luckily, there are ways to combat these behavioral biases and make smarter investing choices. One of the most effective strategies is to create a solid investment plan and stick to it. By setting clear goals and guidelines for your investments, you can avoid making impulsive decisions based on emotion.

Another important strategy is to diversify your portfolio. By spreading your investments across a variety of asset classes, you can reduce the impact of any single investment on your overall portfolio. This can help protect you from the emotional rollercoaster of watching one investment fluctuate wildly in value.

It’s also important to stay informed and educated about the markets. By staying up to date on market trends, economic indicators, and company news, you can make more informed decisions about your investments. This can help you avoid falling victim to biases like confirmation bias, as you’ll have a more comprehensive view of the information available.

In conclusion, mastering behavioral biases is key to avoiding financial fumbles when it comes to investing. By recognizing and understanding the biases that can influence our decisions, we can make smarter choices that are based on logic rather than emotion. By creating a solid investment plan, diversifying our portfolio, and staying informed, we can avoid the pitfalls that can derail our financial goals.

Unlocking the Secrets to Smarter Investing Choices

When it comes to investing, there are a plethora of choices to make. From deciding which stocks to buy to determining when to sell, the world of investing can be overwhelming for even the most seasoned investors. However, by understanding and recognizing common behavioral biases, investors can make smarter choices that lead to more successful outcomes.

One of the key behavioral biases that investors often fall victim to is overconfidence. This bias occurs when investors believe they have more knowledge and expertise than they actually do, leading them to take on more risk than they should. This can result in poor investment decisions and ultimately, losses in their portfolio. By recognizing when you may be feeling overconfident and taking a step back to reassess your decisions, you can avoid this common pitfall.

Another common bias that can impact investing choices is confirmation bias. This occurs when investors seek out information that confirms their existing beliefs, while ignoring or dismissing information that contradicts them. This can lead to a narrow-minded approach to investing and ultimately, missed opportunities for growth. To combat confirmation bias, investors should actively seek out diverse perspectives and consider all sides of an argument before making a decision.

Fear and greed are two emotions that can heavily influence investing choices. Fear of losing money can cause investors to sell off their investments at the first sign of trouble, leading to missed opportunities for long-term growth. On the other hand, greed can drive investors to take on excessive risk in pursuit of high returns, which can backfire and result in significant losses. By keeping emotions in check and sticking to a well-thought-out investment strategy, investors can avoid making hasty decisions driven by fear or greed.

One of the most important aspects of making smarter investing choices is understanding the concept of diversification. Diversifying your portfolio across different asset classes, industries, and geographies can help spread risk and protect against downturns in any one particular investment. By diversifying, investors can increase their chances of achieving consistent returns over the long term, while also minimizing the impact of any individual investment underperforming.

In addition to diversification, it’s also important for investors to have a clear investment plan in place. This plan should outline your financial goals, risk tolerance, and time horizon, guiding your decisions and preventing you from making impulsive choices based on short-term market fluctuations. By sticking to your investment plan and regularly reviewing and adjusting it as needed, investors can stay on track towards achieving their long-term financial goals.

Lastly, seeking advice from a professional financial advisor can also help investors make smarter choices when it comes to investing. A financial advisor can provide valuable insight and guidance based on their expertise and experience, helping you navigate the complexities of the financial markets and make informed decisions that align with your goals and risk tolerance.

In conclusion, by understanding and recognizing common behavioral biases, investors can unlock the secrets to smarter investing choices. By avoiding pitfalls such as overconfidence, confirmation bias, fear, and greed, and instead focusing on diversification, having a clear investment plan, and seeking guidance from a financial advisor, investors can position themselves for success in the world of investing. So, the next time you’re faced with a tough investment decision, remember to keep these tips in mind and make choices that will lead to long-term financial growth and stability.

Understanding Behavioral Biases in Investing