Sparking Independence: Teaching Teens Financial Literacy

In today’s fast-paced world, it is more important than ever to equip teenagers with the knowledge and skills they need to navigate the complex world of finance. Teaching teens financial literacy is not only about helping them manage their money effectively, but it is also about empowering them to make informed decisions and take control of their financial futures.

One of the key reasons why teaching teens financial literacy is so important is that it helps them develop a sense of independence. By learning how to budget, save, and invest, teenagers can gain the confidence they need to make financial decisions on their own. This sense of independence is crucial as they transition into adulthood and start making more significant financial choices, such as taking out loans, buying a car, or even purchasing a home.

Financial literacy also teaches teens the importance of responsibility and accountability. When teenagers are educated about money management, they are more likely to make thoughtful choices about their spending and saving habits. They understand the consequences of their actions and learn to take responsibility for their financial decisions, setting them up for success in the future.

Furthermore, teaching teens financial literacy helps them develop critical thinking and problem-solving skills. As they learn about budgeting, investing, and the impact of interest rates, teenagers are forced to think analytically and strategically about their financial choices. This not only helps them in their personal finances but also prepares them for success in other areas of their lives.

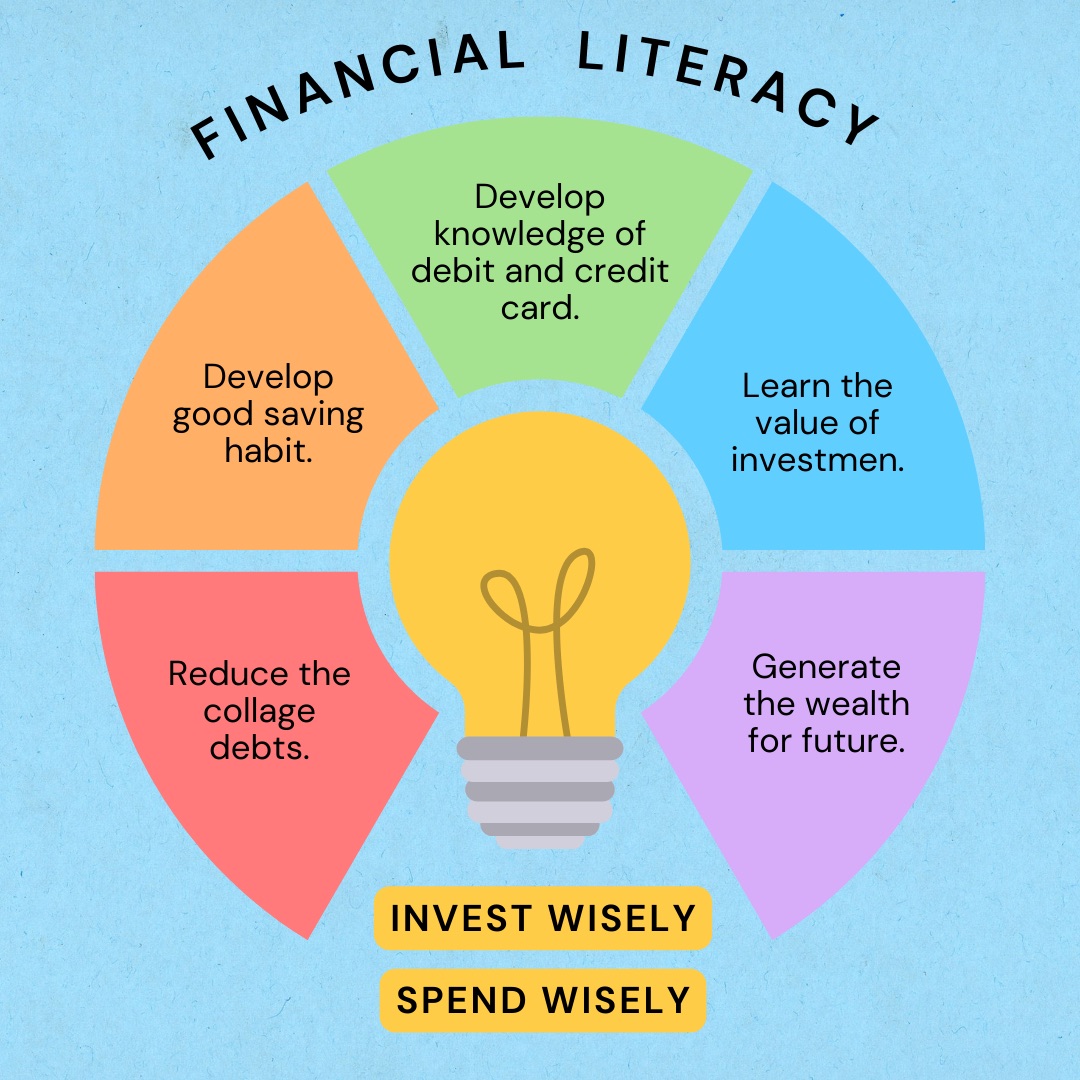

Image Source: ineducationonline.org

Financial literacy also opens up opportunities for teenagers to plan for their futures. By understanding the basics of financial planning, teens can set goals for themselves, such as saving for college, starting a business, or investing in the stock market. This forward-thinking mindset can help them achieve their dreams and build a secure financial future for themselves.

In addition to these practical benefits, teaching teens financial literacy also instills valuable life skills that will serve them well in the long run. By learning about money management, teenagers develop a greater sense of self-awareness and self-control. They learn to prioritize their spending, resist impulse purchases, and delay gratification in favor of long-term goals.

Financial education also promotes good habits and a positive attitude towards money. Teenagers who are taught financial literacy from a young age are more likely to become financially responsible adults who are able to make sound financial decisions and avoid common pitfalls, such as excessive debt or overspending.

Overall, sparking independence in teenagers through teaching financial literacy is crucial for their personal and professional development. By empowering teens with the knowledge and skills they need to manage their money effectively, we can help them build a solid foundation for a successful future. So let’s invest in our teenagers’ financial education and watch them thrive!

Transforming Futures: The Power of Money Management for Teens

In today’s fast-paced world, financial education is more important than ever, especially for teenagers who are on the cusp of adulthood. Learning how to manage money wisely can truly transform a teen’s future, setting them up for success and independence in the years to come.

One of the key aspects of financial education for teens is teaching them the importance of budgeting. By understanding how to create a budget and stick to it, teens can develop valuable skills that will serve them well throughout their lives. Budgeting helps teens learn to prioritize their spending, differentiate between needs and wants, and save for the future. It empowers them to take control of their finances and make informed decisions about how to use their money wisely.

Another crucial component of financial education for teens is teaching them about the importance of saving. Encouraging teens to save a portion of their income, whether it be from part-time jobs, allowance, or gifts, can help instill a sense of financial responsibility and discipline. Saving money allows teens to build a financial cushion for emergencies, achieve their long-term goals, and develop good financial habits that will benefit them well into adulthood.

Investing is another key concept that teens should learn about as part of their financial education. While investing may seem intimidating at first, teaching teens the basics of investing can help them understand how to grow their money over time. Whether it’s investing in stocks, bonds, mutual funds, or real estate, teens can learn about the power of compounding interest and the importance of diversification in building wealth over the long term.

Understanding the concept of credit and debt is also essential for teens as they navigate the financial world. Teaching teens how to use credit responsibly, avoid debt traps, and manage their debt effectively can help prevent financial pitfalls in the future. By instilling good credit habits early on, teens can build a solid credit history and maintain a healthy financial standing as they transition into adulthood.

Lastly, financial education for teens should also include lessons on the importance of giving back and being socially responsible with their money. Teaching teens about the value of philanthropy, charity, and helping others in need can foster a sense of empathy and generosity that will benefit not only the recipients but also the teens themselves. By making giving a part of their financial habits, teens can learn the joy of making a positive impact on the world around them.

In conclusion, financial education is a powerful tool that can truly transform the futures of teens. By teaching teens how to budget, save, invest, manage credit and debt, and give back, we can empower them to make informed financial decisions, achieve their goals, and build a secure financial future. With the right knowledge and skills, teens can take control of their finances, pursue their dreams, and ultimately lead successful and fulfilling lives.

The Benefits of Financial Education for Teens